Happy Birthday, CCL!

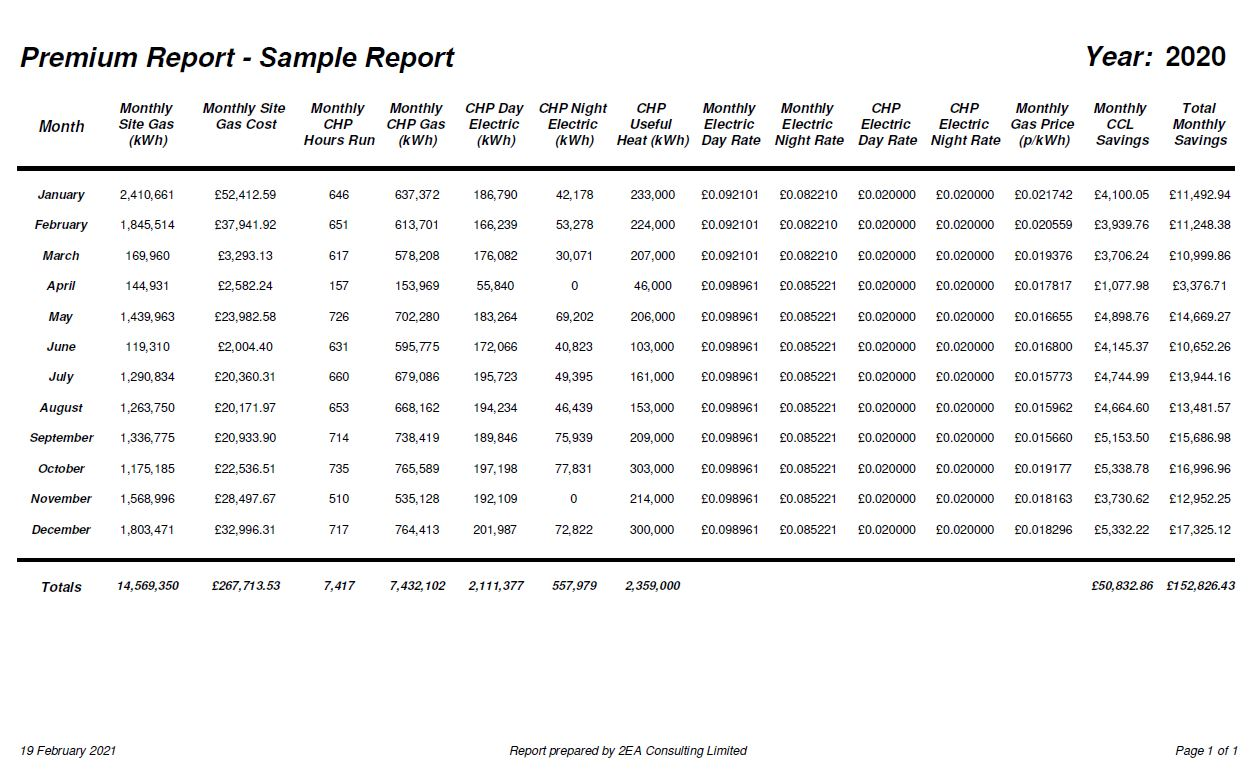

- CHP Operation – Financial and Carbon Savings

- CCL Calculator

- CCL & CHPQA Management Service

- Legislation Timetable

2021 marks 20 years of Climate Change Levy (CCL).

The Early Years

Climate Change Levy (CCL) was introduced in 2001 under the Finance Act 2001 for non-domestic organisations. It is one of the longest running energy based policies to date. CCL was initially offset by a reduction in National Insurance contributions for businesses and was launched to encourage them to operate in a more environmentally friendly way. The levy is applied to electricity, gas, liquid petroleum gas (LPG) and solid fuels. However, exemptions for supplies from certain energy sources apply.

Climate Change Levy appears on non-domestic electricity and gas bills as CCL. It is applied at the time of supply and is calculated based on the amount of energy being supplied. CCL is charged by the supplier of the taxable commodity. Suppliers then pay the collected tax to HM Revenue and Customs. CCL is often shown as a separate line item on energy bills (usually above the VAT line) and is also VAT chargeable. It is charged at a flat rate on every kilowatt-hour (kWh) of energy used. However, businesses with very low energy consumption are considered to be exempt from the levy. The majority of charities and non-profit organisations also qualify for automatic exemption.

From 2001 to 2007 the applied rates remained the same.

| Taxable Commodity Rate | Rates from 1st April 2001 |

|---|---|

| Electricity (£/kWh) | £0.0043 |

| Gas (£/kWh) | £0.0015 |

| LPG (£/kg) | £0.0096 |

From 2007 the rates were set to rise year on year except for 2010 where there was no rate rise.

| Taxable Commodity Rate | Rates from 1st April 2007 |

|---|---|

| Electricity (£/kWh) | £0.00441 |

| Gas (£/kWh) | £0.00154 |

| LPG (£/kg) | £0.00985 |

| Commodity | 1st April 2008 | 1st April 2009 | 1st April 2011 | 1st April 2012 | 1st April 2013 | 1st April 2014 | 1st April 2015 |

|---|---|---|---|---|---|---|---|

| Electricity | £0.00456 | £0.00470 | £0.00485 | £0.00509 | £0.00524 | £0.00541 | £0.00554 |

| Gas | £0.00159 | £0.00164 | £0.00169 | £0.00177 | £0.00182 | £0.00188 | £0.00193 |

| LPG | £0.01018 | £0.01050 | £0.01083 | £0.01137 | £0.01172 | £0.01210 | £0.01240 |

The later years

In 2016, the government abolished the Carbon Reduction Commitment (CRC), another piece of mandatory reporting legislation, due to it causing double reporting on carbon emissions and concern over burdensome reporting requirements by industries required to report under the framework. With this loss of revenue, the government further announced it was to increase the rates of CCL to cover this loss. This was a substantial increase of around 51% for most sectors from 2019. From 2021/2022 electricity rates will slowly decrease to fall in line with the rate for gas.

| Commodity | 2016/2017 | 2017/2018 | 2018/2019 | 2019/2020 | 2020/2021 | 2021/2022 | 2022/2023 | 2023/2024 |

|---|---|---|---|---|---|---|---|---|

| Electricity | £0.00559 | £0.00568 | £0.00583 | £0.00847 | £0.00811 | £0.00775 | £0.00775 | £0.00775 |

| Gas | £0.00195 | £0.00198 | £0.00203 | £0.00339 | £0.00406 | £0.00465 | £0.00568 | £0.00672 |

| LPG | £0.01251 | £0.01272 | £0.01304 | £0.02175 | £0.02175 | £0.02175 | £0.002175 | £0.002175 |

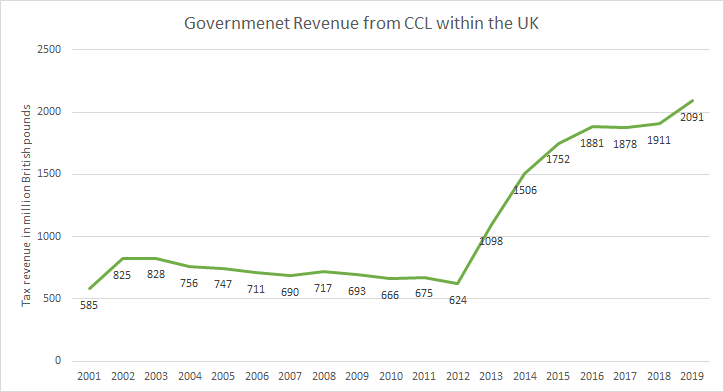

CCL in financial terms

The income generated for the government from CCL rose to over £2.1bn in 2019 compared to the income generated in 2001 of only £585m. In 20 years CCL has brought in a total of £20.6bn

The cost of CCL to individual businesses can vary greatly and there are ways to mitigate or claim exemption for CCL. Below are three real life examples of the cost of CCL using actual energy consumption; a hospital to reflect a site that runs 24/7, a supermarket that reflects a site that runs almost 24/7 and an office that usually shuts in the evenings and on weekends.

The Hospital

A major hospital operates around the clock. Based on actual energy consumption of one of these hospitals, and using the rates that came into effect on 1st April 2021, the hospital would expect to pay £122,509.80 in CCL costs.

| Sector | Annual Consumption (kWh) | CCL Rates – 2021/2022 | CCL Payable – 2021/2022 | ||||

|---|---|---|---|---|---|---|---|

| Electricity | Natural Gas | Electricity | Natural Gas | Electricity | Natural Gas | Total CCL Payable | |

| Hospitals | 11,595,555 | 7,020,269 | £0.00775 | £0.00465 | £89,865.55 | £32,644.25 | £122,509.80 |

The Supermarket

All large scale supermarkets usually operate 24/7 with a small window on Sundays to close and restock without disruption. Based on actual energy consumption of one of these supermarkets, and applying the same rates as above, the supermarket would expect to pay around £33,788.89 in CCL costs.

| Sector | Annual Consumption (kWh) | CCL Rates – 2021/2022 | CCL Payable – 2021/2022 | ||||

|---|---|---|---|---|---|---|---|

| Electricity | Natural Gas | Electricity | Natural Gas | Electricity | Natural Gas | Total CCL Payable | |

| Supermarkets | 3,791,180 | 947,795 | £0.00775 | £0.00465 | £29,381.65 | £4,407.25 | £33,788.89 |

The Office

Most offices close in the evenings and on weekends. Based on actual energy consumption of an office, and applying the same rates as above, a typical office would expect to pay around £5,290.44 in CCL costs.

| Sector | Annual Consumption (kWh) | CCL Rates – 2021/2022 | CCL Payable – 2021/2022 | ||||

|---|---|---|---|---|---|---|---|

| Electricity | Natural Gas | Electricity | Natural Gas | Electricity | Natural Gas | Total CCL Payable | |

| Office Blocks | 396,715 | 476,537 | £0.00775 | £0.00465 | £3,074.54 | £2,215.90 | £5,290.44 |

Exemption, Relief and Reduction

There are three ways to either reduce or claim exemption from CCL:

Climate Change Agreements (CCAs)

A CCA is a voluntary contractual agreement between an organisation and the Environment Agency (EA). The organisation, usually an industrial company, agrees to report energy use against a target to the EA.

CCAs are a UK Government initiative with the objective of reducing industrial energy use and CO2 emissions. For those organisations involved at the time, the first reporting period was in 2002. In their current form, CCAs are to continue operating until 31st March 2023.

Legislation within the Finance Act 2000 made provision for a reduced rate of the levy for energy-intensive industries that have entered into a negotiated energy efficiency Climate Change Agreement (CCA).

CHPs and the CHPQA

A second option is to install and operate a Combined Heat & Power (CHP)?.

A second option is to install and operate a Combined Heat & Power (CHP)?.

What is a CHP?

Combined heat and power, also known as cogeneration or CHP, is an extremely efficient process that produces electricity and heat from natural gas.

In the simplest terms, a CHP unit consists of a large internal combustion engine, similar to engines that are used in cars. The unit is installed onsite and connected to the grid. Gas and air is pumped into the engine, which can be anything from a V6 to a V20, that then drives a generator to produce the electricity for the site.

As the unit produces electricity, it also generates heat. This heat can also be used onsite for heating or can be ejected through a heat dump.

Once installed and running, an operator can register their CHP with the Combined Heat & Power Quality Assurance (CHPQA) Programme. The CHPQA Programme was introduced at the same time as CCL in 2001 and, like most government programmes, has developed tighter rules to ensure the programme works to its best abilities.

The CHPQA is a government initiative that aims to provide a method for assessing all types and sizes of CHP schemes throughout the UK. Participation in the scheme is voluntary, however, successful CHPQA certification grants eligibility to a range of benefits. One of those benefits is claiming exemption from CCL.

Energy Auditing

If your organisation is unable to obtain a CCA or would not benefit from a CHP, then the third option is to conduct an energy audit. An energy audit identifies opportunities to reduce your overall energy consumption by providng recommendations that include upgrading equipment and staff engagement strategies. Implementing these findings can reducde both your sites energy and CCL costs.